Computer Modelling Group (CMG $18.00 Canadian) is the leading provider of simulation software used by energy companies to model underground reservoirs. Customers rely on the technology to test a range of possible production strategies so that the most efficient method is identified. The process continues for as long as the field remains productive. Conditions change over time as reserves are brought to the surface, causing new approaches to become better solutions. Schlumberger and Halliburton, the two leading oilfield services companies the world, dominated the industry since its inception in the mid-1980s. The advent of supercomputers made by Silicon Graphics and Cray Computer made it feasible to perform the analysis on computers. Schlumberger and Halliburton focused on so-called "black oil" reservoirs, which involved relatively straightforward drilling programs. Computer Modelling entered the fray a decade later with an emphasis on hard to produce reserves, among them heavy oil and tar sand projects. The company has continued to invest aggressively in the technology, leveraged by third party funding relationships that leave Computer Modelling with 100% ownership of the intellectual property.

Growth is accelerating as new oil discoveries become increasingly complex. Computer Modelling is gaining market share as exploration moves towards reserves that are more difficult to drill. Software sales tend to be made on a project by project basis, and the programs tend to stick with each project until the field is completely exploited. Since most of the easy to produce oil already has been discovered, new business is gravitating towards more complicated fields. Computer Modelling's large competitors still control a number of major oil company accounts (especially the national ones), so despite its superior technology the company still holds a minority share of the market. But that percentage has been rising over the past decade as more geophysicists familiarize themselves with the software, and a growing number of top tier energy companies sign on as customers.

A new product line offers additional leverage. Computer Modelling has been developing a more comprehensive system in combination with Shell and Petrobas over the past four years. The technology encompasses all of a project's above ground facilities in addition to reservoir modelling, and appears to be ideally suited for deep offshore drilling. Petrobas plans to put the software to the test on an unnamed project starting this week. The company recently raised $75 billion to develop the world's largest offshore oil discovery in Brazil. That might be it. Shell is starting a project of its own. If the software performs as expected further expansion in those two companies is likely. Commercial sales to other oil companies probably would follow in future years.

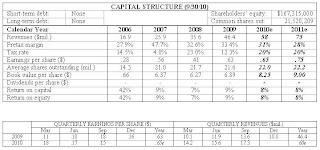

Earnings are rebounding following a temporary decline in fiscal 2009 (March '10). Energy companies around the world delayed projects last year due to the recession and the uncertainty that created about the future of energy prices. Now that crude has stabilized in the $70-$80 per barrel range, and interest rates remain low, many of those projects have gotten underway again. Computer Modelling netted $.85 a share (Canadian) last year, down from $.99 a share the year before. (Please refer to our "Accounting Notes" section.) In the current fiscal year, ending next March, we estimate income will rebound to $1.10-$1.30 a share. The company sells licenses on an annual basis, and as perpetuals that customers own forever. Annuals sell at about 40% of the perpetual price. Perpetual licenses generate annual maintenance fees equal to 20% of the selling price, entitling the owner to software updates as they come available. Either way, the company creates a long term recurring revenue stream. Perpetual sales generate more income right away, though. So this year's exact income figure will hinge on how the license sales are split up.

We estimate total revenues will rise 21%-33% to $55-$60 million. In the first quarter (June), earnings advanced 50% to $.24 a share on an 18% revenue increase ($12.1 million). In 2-3 years earnings could reach $1.75 a share on sales of $70 million. Applying a P/E multiple of 25x suggests a target price of $45 a share, potential appreciation of 150% from the current quote. Note - The stock also trades in the United States on the Pink Sheet exchange under the ticker symbol CMDXF.