Government mandated reimbursement cuts are likely in the September quarter. China implemented a wide ranging health plan in 2010. A key trade off for industry participants has been a big increase in the number of people covered in exchange for lower prices. Another round of price reductions is expected. The specifics will vary depending on a variety of factors. But 3-S Bio anticipates an average hit of 10%-20%.

Manufacturing margins currently are nearly 90%. That's typical of drug companies around the world. 3-S Bio expanded capacity threefold in 2010 to meet the expected rise in demand the new health care envisioned. The company still is operating at 50%-60% of capacity. While margins will be impacted by the upcoming price reductions, rising volume promises to offset the full effect. More efficient sales operations could alleviate the pressure on margins, as well. And 3-S Bio is actively seeking additional products to feed through its distribution network. Meantime, exports to emerging markets like Turkey and Egypt are growing quickly due to the products' efficacy and relatively low price points compared to American and European offerings.

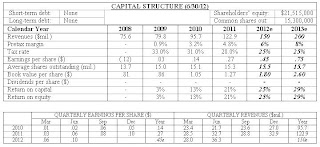

We have reduced our 2013 earnings estimate by a dime to $1.05 a share. That figure assumes the upcoming reimbursement changes will approach the high end of the range. A somewhat stronger performance is possible if the cuts prove less severe than expected. Downside risk remains modest. The stock trades close to book value ($9.45 a share). Cash and equivalents total $124 million ($5.62 a share). The Chinese population is aging quickly, suggesting above average industry growth for an extended time. A joint venture with U.S. based Davita to run a network of kidney dialysis centers promises further leverage. That project is slated to start rolling out next year.

( Click on Table to Enlarge )