3S Bio (SSRX $14.50) is on track to produce excellent on target Q4 results. The Chinese government issued a revised set of reimbursement prices for certain drugs this week. That's part of the national health care law that went into effect in 2009. 3S Bio's two main products were not affected by the change. The drugs that were impacted suffered an approximate 20% price reduction. The government insurance program accounts for most of the Chinese market. Coincident with the government's updated price list was a plan to expand health care spending by 25% next year, to boost the number of people covered and provide more comprehensive treatment. 3S Bio remains vulnerable to future government price mandates, although the company's bargaining position is pretty strong in that its lead product (TPAIO) does not face any direct competition. Use of that product currently is restricted to "work related injuries," even though its primary application is in chemotherapy. The company presently serves only 5%-10% of the potential market. And that potential market is thought to be just a third or less of what it might be, since a large number of prospective patients are never treated. It's possible that labeling could change for the better if a lower pricing schedule is handed down.

Another new product recently was added to the R&D pipeline. That licensed drug treats gout, a fairly common affliction in China, and currently is in Phase II clinical trials. More international partnerships could emerge. We continue to estimate 2010 earnings will finish around $.65 a share. Next year $.75 a share remains a realistic target.

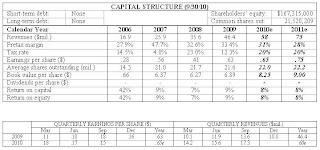

( Click on table to enlarge. )