L&L Energy (LLEN $2.00) is a small but ambitious Chinese coal producer. The company is managed by American nationals who live in China. L&L has five coal mines with about 75 million tons of reserves. Coal production represents approximately 30% of sales (60% of earnings). It also runs two coal washing plants, three wholesale distribution networks, and a coking facility. Washing eliminates impurities. Coking produces higher quality coal used in steel making. Operations are located in the central part of the country, in Guizhou and Yunnan provinces. That's a relatively new coal producing region. L&L Energy invests heavily in capital equipment to boost safety and productivity, similar to the more mature mining regions in China. A lot of the neighboring mines are owned by small under-capitalized operators. Many of those mine just a sliver of the reserves they control. They also tend to rely on manual labor and skimp on safety measures.

The central Chinese government established a new road map for the industry in 2009. It set a goal of consolidating the coal industry into 300 large scale producers with the capital and expertise to industrialize operations, mine more of the nation's untapped reserves, reduce costs, and improve safety. That program hit a speed bump in 2010 when a series of deadly accidents occurred. The government shut down large sections of the industry right away, and proceeded to inspect each mine individually before allowing them to start operating again. In many cases production limits were implemented after the inspections were finished. Those delays caused a sharp decline in L&L Energy's results in fiscal 2011 (April). L&L Energy wasn't hit with any sanctions. But coal output suffered. The services it provides to other coal producers experienced substantial blows, as well.

Political uncertainty has created regulatory inertia. The central Chinese government is establishing a new leadership group. That transition occurs every ten years. The final roster will become official next month (November 2012). A high level murder trial delayed the process. Bureaucrats in charge of the coal industry have tread lightly during the changeover. That's put a damper on L&L Energy's expansion efforts. There still exists some risk that the original road map will be changed. But the underlying fundamentals indicate the industry should resume its march towards becoming more modernized. Coal accounts for 80% of the country's electricity. Reserves are high. Alternatives like oil and natural gas are in short supply. Economic growth in China has moderated over the past year to a 4%-5% rate (7%-8% officially). Coal production has trailed development for the past decade, though, so a substantial opportunity exists to displace imports from Vietnam, Australia, and North America. If costs can be reduced and output raised GDP and employment could benefit.

Acquisitions promise to leverage results. If the Chinese government continues its existing plan for the coal industry thousands of small producers will be forced to sell out to larger companies. The consolidation currently is slated to wind up in 2015. L&L Energy already has made several deals that were simple business combinations, that weren't related to the government's consolidation rules. Currency controls in China tend to make L&L Energy's U.S. traded stock attractive to prospective sellers. It's a convenient and legal tool for getting money out of the country. Future deals are likely to involve stock, cash, and earnouts in combinations that yield immediate bottom line benefits.

Coal prices have begun to strengthen. L&L Energy is less vulnerable to import competition than much of the Chinese industry because of its location in the interior of the country. Still, the surge in imports had exerted indirect pressure on prices earlier in the year. Industrywide inventories have reverted to normal levels, helping profitability improve in recent months. Costs remain under control. And more outside producers have been signed up to use L&L Energy's washing and distribution services.

The long term outlook is bright. Organic growth is likely to accelerate once the new government takes over and the regulatory cloud lifts. Further acquisitions already are being pursued. And overall energy demand continues to rise. China is aggressively developing its natural gas fracking industry. That still accounts for a minor part of the total energy mix but it is likely to expand materially over the coming decade. Serious thought is being given to using that resource for transportation, though, rather than electricity production. Hydro-electric output already is at full capacity. And while some solar installations are being built most of the panels made in China still are exported.

We estimate sales will rise 39% in fiscal 2103 (April) to $200 million. Income could advance 70% to $.85 a share. Our 2-3 year projection assumes 15 million more shares outstanding than at present, to finance the company's acquisition program. Sales could reach $500 million to provide earnings of $1.65 a share. Our baseline case, excluding acquisitions, puts revenue at $350 million and earnings at $1.50 a share (modest share count increase). Applying a P/E multiple of 7x to the lower figure suggests a target price of $10 a share, potential appreciation of 400% from the current quote.

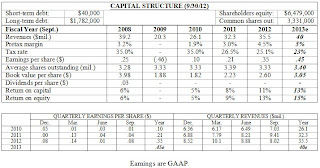

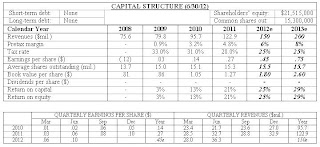

( Click on Table to Enlarge )