The new mines promise to boost overall results immediately. Both have been developed on a limited basis to date, but the infrastructure has been created to facilitate mechanized operations. L&L Energy hopes to lift output substantially over the coming year. Our fiscal 2013 (April) estimates could be understated. Sequential gains are likely even if the mines are not expanded. Incremental improvement has the potential to be meaningful since margins on coal sales are relatively high.

The Chinese coal market is heating up again. Overcapacity plagued the industry earlier in the year as the economy stalled. New political leadership has assumed the helm in China. Stimulative measures are being introduced to enhance economic growth in upcoming periods. Coal prices have firmed in recent months. Inventories are being worked off as the winter heating season kicks in. If prices advance further L&L Energy's margins could widen.

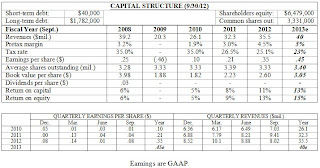

Earnings are poised to accelerate even if coal prices don't improve. Higher coal production from L&L Energy's new and existing mines are likely to deliver substantial bottom line improvement. More wholesale deals, which yield low margins but help the company market its own output by raising overall volume, could support rapid top line gains, as well. In the absence of additional property acquisitions we estimate fiscal 2014 (April) income will climb 50%-75% to $1.25-$1.50 a share. Revenues have the potential to jump 35%-50% to $275-$300 million. A higher stock price could lead to even faster growth by facilitating the acquisition of larger properties. Sellers are attracted to the company's U.S. based stock, which provides a mechanism for escaping China's rigid currency controls. Government regulations are forcing the industry to consolidate, moreover, creating an additional tailwind.

Currency controls do limit L&L Energy's ability to repatriate cash to U.S. stockholders. The stock itself can be sold without consequences. But dividend payments and other cash transfers likely would be taxed at a 35% exit rate. Those payments might not be deductible for U.S. income tax purposes. In 2-3 years a more realistic system could be implemented as part of an overall treaty between America and China. Failing that, L&L Energy has plenty of opportunity to reinvest earnings at a high rate of return in China, improving the company's overall value.

( Click on Table to Enlarge )