Sevcon is continuing to expand its engineering force. The company historically has focused on control systems for electric vehicles. That emphasis will be continued. Electric off road machines already have demonstrated superior price performance characteristics. And automotive demand is poised to increase in response to rising (fleet) fuel efficiency standards. Sevcon's expansion is aimed at the high potential hybrid sector. That technology delivers good performance and attractive pricing while being compatible with the existing re-fueling infrastructure.

We have reduced our fiscal 2013 (Sept.) estimates. Sevcon has several high potential projects in the pipeline. But poor macro economic conditions could cause those programs to be delayed or scaled down. Existing business is difficult to predict, as well, for the same reason. The long term outlook remains bright. Ineffective government involvement presents a risk, however. And with the re-election of Barack Obama it's hard to see reason why that participation will yield better results in the future. Despite the government's negative showing the industry remains likely to make progress over the next several years. Sevcon has a very small share base, so it won't take much to get the stock moving.

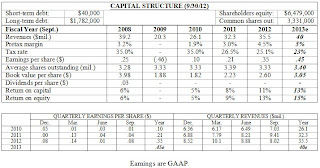

( Click on Table to Enlarge )

No comments:

Post a Comment