Coastal Contacts (COA.to $5.85) is a leading Internet provider of contact lenses to consumers in Canada and Northern Europe. Over the past few years the company has developed a second product line for eyeglasses. That segment now accounts for approximately 25% of sales. Eyeglasses normally are sold at extremely high prices in relation to cost at retail stores and optometrist offices. Coastal Contacts has created its own manufacturing facilities which, combined with an online distribution network, facilitates pricing that's 40%-60% below conventional levels for identical brands and models. Customer acquisition is more challenging than contacts because the concept is new and customers are uncertain how well the glasses will fit and look. So Coastal Contacts has had to resort to promotional offers to get customers in the door. In Canada and Europe, where the company has operated for the most part to date, repeat business has been excellent, though. And most users refer additional customers, indicating high levels of satisfaction. The core contact lens business is relatively mature and provides a positive cash flow. Earnings have declined in recent years as that money and more has been invested in developing the eyeglass segment. Profits in Canada and Europe are starting to emerge as repeat orders comprise a rising share of the business. Those sales yield attractive gross margins due to Coastal Contacts' vertical integration and efficient web-based marketing platform. During the past year efforts were stepped up to penetrate the U.S. eyeglass market. Sales already are advancing at greater than 100% a year. Even faster gains are possible as advertising expands, renewals kick in, and referrals contribute further -- replicating the success model in Canada and Europe.

A recent stock offering reinforced finances. Coastal Contacts sold 3.0 million shares at $6.00 a share, raising $17 million after expenses. Those funds will be earmarked mainly to support expansion in the U.S. eyeglass market. Facilities were improved last year, doubling capacity. Most Internet competitors outsource production to Asia, lengthening turnaround times. Coast Contacts typically delivers within a few days. Quality control is superior, as well, since any errors can be corrected immediately and at low cost. Coastal Contacts shipped 987,452 sets of glasses in the fiscal year ended October, 2012, up 272% from two years before. A high percentage were low margin promotional deals, designed to get new users to sign up. Even so, overall gross margins improved to 43% from 39% due to the superior profitability the eyeglass business provides. As normally priced glasses (still 40%-60% below regular retail) comprise a larger share of total sales both revenue and margins promise to widen materially.

We estimate financial performance will remain muted in fiscal 2013 (Oct.) due to the promotional effort to penetrate the U.S. eyeglass market. Sales advanced 17% in the January period to $54.9 million. But selling and marketing costs jumped 45%, leading to a loss of $.11 a share. Eyeglass sales rose 35% to $13.9 million. Eyeglass units increased 42% to 277,159. Eyeglass gross margins improved to 46% despite high levels of discounted pricing. U.S. eyeglass sales jumped 95% and now represent about 50% of the company's total eyeglass volume.

The eyeglass market is approximately 9x larger than the contact lens segment. Only a small fraction has shifted to the Internet to date. But the pricing advantage could precipitate a wholesale change, similar to what happened in the contact segment. The retail sector is bound to fight back. Unless it completely restructures, though, Coastal Contacts should remain the low cost provider by a wide margin. The company's strongest Internet competitors provide their own proprietary designs, which generally are upscale and attract a younger hip demographic. Coastal Contacts goes for that market, as well, with brand name designers. But the largest portion of its business is generated by cost conscious consumers, often families buying multiple pairs for children. Weak economic conditions promote demand from a broad range of buyers, as well.

Margins promise to widen as volume builds. As advertising and promotion level off in absolute terms the company's high gross margins should yield substantial operating income leverage. Over the long haul (4-5 years) pretax margins could rise into the 20% vicinity. We estimate profitability will expand about half that far within 2-3 years. Sales could reach $300-$325 million to provide fully taxed earnings of $.50-$.70 a share. Applying a P/E multiple of 30x to the midpoint of the range (reflecting the company's further margin potential) suggests a target price of $18 a share, potential appreciation of 200% from the current quote. Limits are advised when placing orders. The shares also trade on the Nasdaq exchange under the ticker symbol "COA."

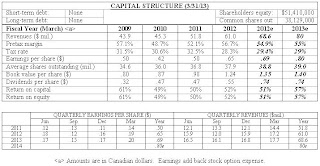

( Click on Table to Enlarge )