Demand remains vibrant. Computer Modelling continues to fare best in the North American market. Activity in Calgary and North Dakota is continuing to expand at a superior pace. The U.S. oil fracking market is thriving as costs come down, helped in growing measure by broader software use. Tar sand costs are falling, as well. Each of those areas is believed to possess potential reserves that are bigger than Saudi Arabia's. A price collapse in the oil market remains a significant risk. In theory worldwide demand for petroleum should be exploding as Third World countries modernize their transportation systems. The ongoing recession has muted demand, though. And most OPEC producers depend on their oil income, making it unlikely they'll cut production. Prices have held up so far because the Obama Administration has virtually eliminated Iran from the picture. The U.S. and Canada have picked up the mullahs' market share. Further output increases could start putting pressure on prices, though, unless economic activity rebounds. Fracking and tar sand costs are declining, so a bigger cushion is being created. But a big acceleration in sales probably won't emerge until unit volume demand accelerates, forcing energy producers to develop even more challenging fields.

Natural demand promises to advance in the Middle East. That's been Schlumberger's province for decades. And the French oilfield services giant probably will continue to supply a sizable share of the software market over the long haul due to its tight customer relationships. But even in the Middle East oil has become increasingly difficult to recover. Computer Modelling has the best technology for exploiting difficult reserves. The company already is working with Halliburton in North America. If worldwide demand takes off Computer Modelling could make some direct forays in the Middle East as those kingdoms try to rebuild their own reserve bases. A collaboration with Schlumberger, while it's unlikely at this point, could develop.

The company's next generation system is slated for launch in the December quarter. That project was funded equally by Shell and Petrobas, which also supplied part of the engineering team. Computer Modelling retains exclusive ownership and marketing rights to the technology. Shell and Petrobas get first shot at using the software. It should be a pretty big deal.

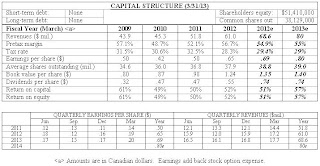

( Click on Table to Enlarge )

No comments:

Post a Comment